Report on Intelligent Investment Q1 2025 Commercial Real Estate Market Reports Investment | Office | Retail | Industrial & Logistics CBRE RESEARCH Q1 2025

| The Baltic commercial real estate market entered 2025 with continued momentum toward prime and alternative asset classes. The retail sector attracted the most attention from investors for the fourth quarter in a row, and investments in the industrial sector started to grow in Q1. Although geopolitical tensions and global trade uncertainties still shape the market, it is likely that trade within the inner EU networks will increase. Therefore, forward-looking investors are leveraging market dislocations to secure long-term value.

As Q2 2025 unfolds, we encourage you to explore these evolving trends more closely. The Baltic markets offer untapped potential and strategic openings for those ready to adapt.

For customized insights tailored to your investment or development goals, connect with our dedicated Research team today. |

|

| Baltic Real Estate Market Q1 2025 |  |

|

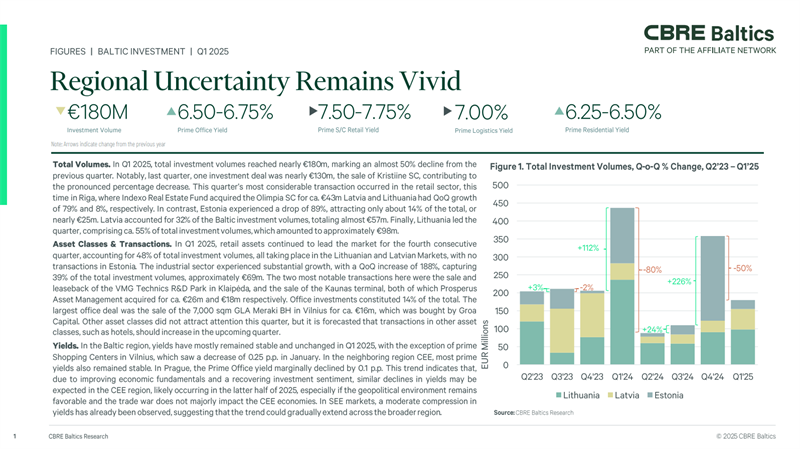

|  | | Investment KPIs | | In Q1 2025, investment volumes decreased by 50% from the previous quarter, totaling €180 million. Estonia saw a significant decline of 89% in investment volumes, while Latvia and Lithuania experienced quarter-on-quarter growth of 79% and 8%, respectively. | |

|

|---|

|

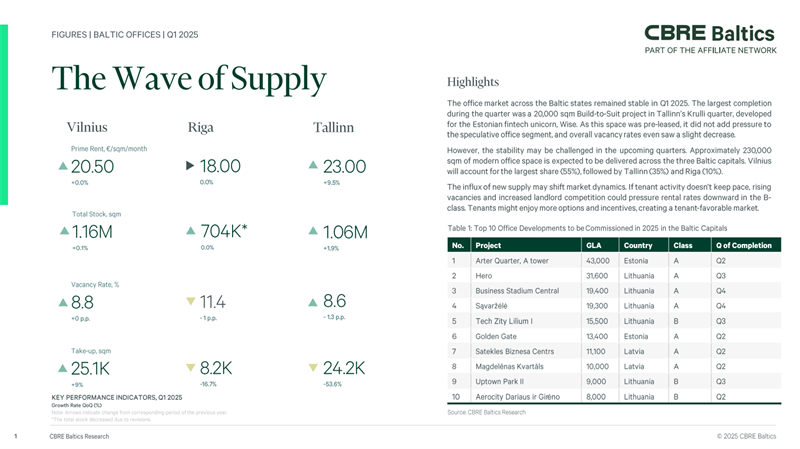

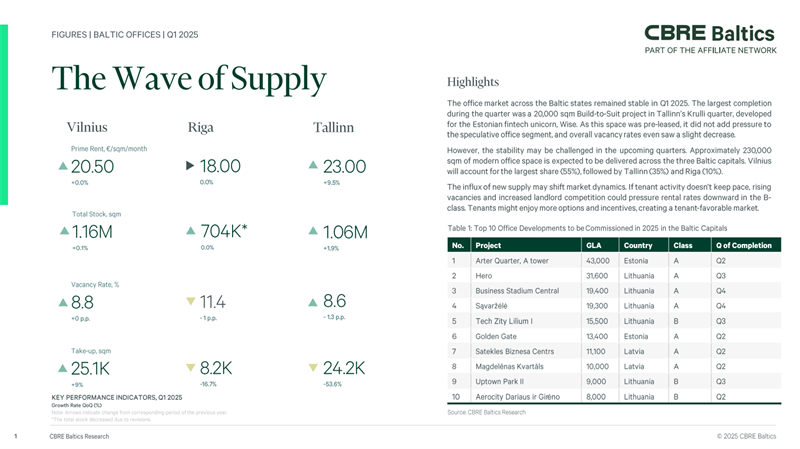

|  | | Office KPIs | The office market across the Baltic states remained stable in Q1 2025. The largest completion during the quarter was a 20,000 sqm Build-to-Suit project in Tallinn’s Krulli quarter, developed for the Estonian fintech unicorn, Wise. However, the stability may be challenged in the upcoming quarters. Approximately 230,000 sqm of modern office space is expected to be delivered across the three Baltic capitals. | |

|

|---|

|  | | Retail KPIs | In the first quarter of 2025, the Baltic retail market demonstrated a stable trend, featuring several key developments in the region, none in Estonia, one in Latvia and three in Lithuania. Retail demand across the Baltic region remains uneven. | |

|

|---|

|  | | Industrial & Logistics KPIs | In Q1 2025, a total of six I&L projects, or 116,000 sqm, were completed across Vilnius, Kaunas, Klaipëda, Riga, and Tallinn, representing a nearly 50% decrease compared to Q4 2024, and bringing the total stock to almost 5.54 mln. sqm. | |

|

|---|

|

| Regional Perspective: Central-Eastern European Market Q1 2025 |  |

|

|  | | Investment KPIs | | Following the robust year-end, investment sentiment has remained solid as we stepped into 2025. The CEE markets registered ca. 3.3 B EUR investment turnover in the first three months of the year. While this figure indicates a marked decline on a quarterly basis (-25%), it was up significantly y-o-y (+84%) and was among the three highest values registered in Q1 over the last 20 years. | |

|

|---|

|

| Baltic Research Team |  |

|

| |

|

|