| The Baltic commercial real estate market is evolving, with a clear shift toward alternative assets and prime properties, which are set to outperform traditional sectors. In an environment where interest rates remain above historical averages and geopolitical uncertainties persist, conventional investments face headwinds. Yet, in times of challenge, savvy market players find new opportunities. As we look ahead to 2025, we invite you to dive deeper into these trends. The Baltic markets are rich with potential, and we’re here to help you navigate the opportunities ahead. For a tailored analysis on how these insights could impact your project, connect with our dedicated Research team today. |

|

| Baltic Real Estate Market Q4 2024 |  |

|

|  | | Baltic Market Outlook 2025 | | How will projected economic growth and investment in 2025 shape the real estate market? Discover the latest trends, predictions, and insights in our Outlook to refine your strategies today. | |

|

|---|

|

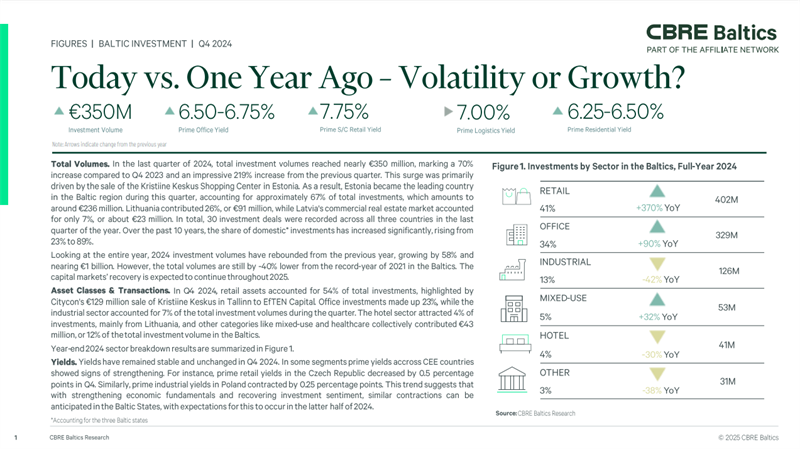

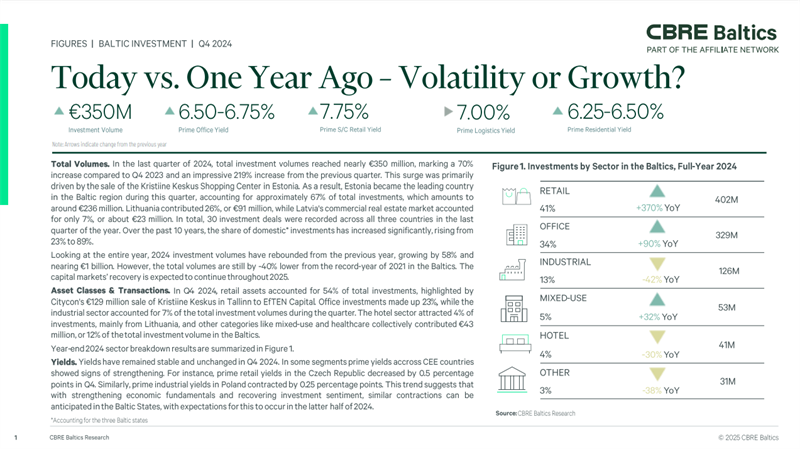

|  | | Investment KPIs | | Looking at the entire year, 2024 investment volumes have rebounded from the previous year, growing by 58% and nearing €1 billion. However, the total volumes are still by -40% lower from the record-year of 2021 in the Baltics. | |

|

|---|

|

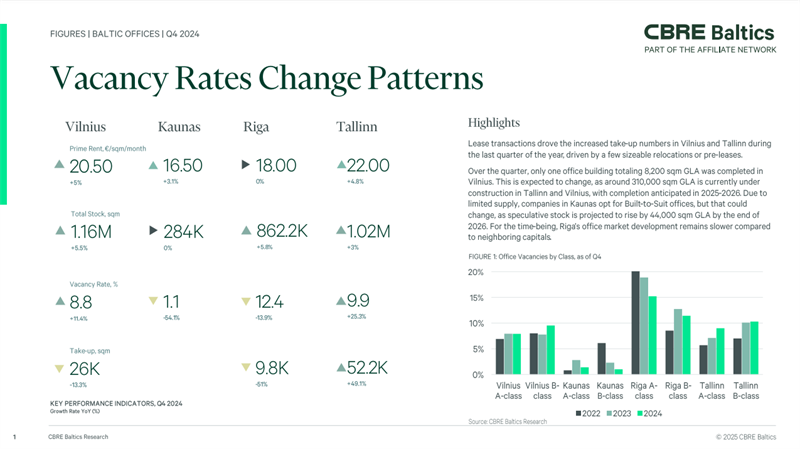

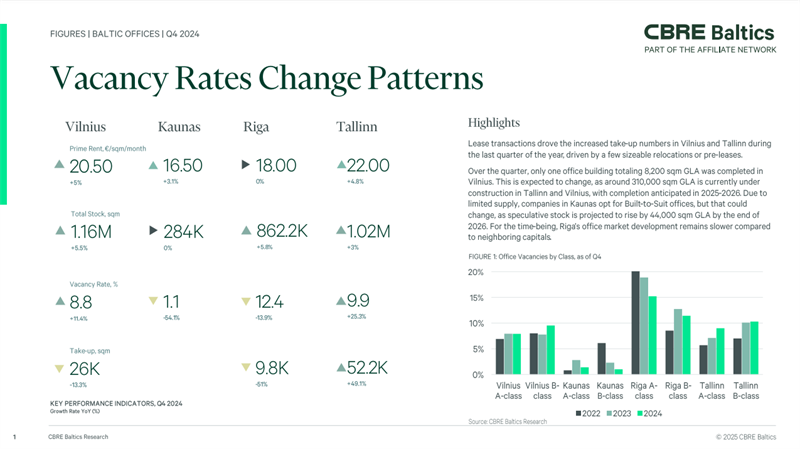

|  | | Office KPIs | Over the quarter, only one office building totaling 8,200 sqm GLA was completed in Vilnius. This is expected to change, as around 310,000 sqm GLA is currently under construction in the Baltic capitals, with completion anticipated in 2025-2026. | |

|

|---|

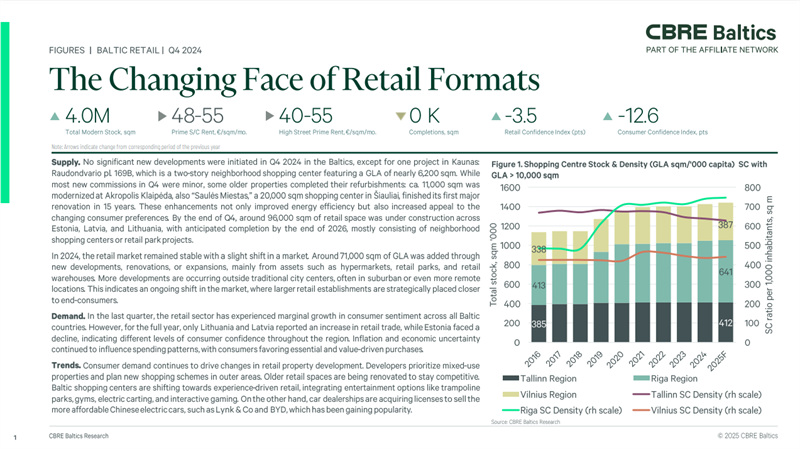

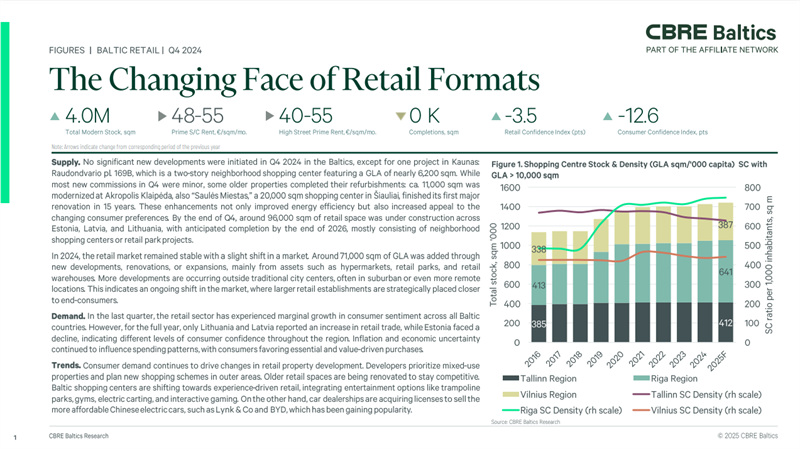

|  | | Retail KPIs | In 2024, the retail market remained stable with a slight shift in a market. Around 71,000 sqm of GLA was added through new developments, renovations, or expansions, mainly from assets such as hypermarkets, retail parks, and retail warehouses. More developments are occurring outside traditional city centers, often in suburban or even more remote locations. | |

|

|---|

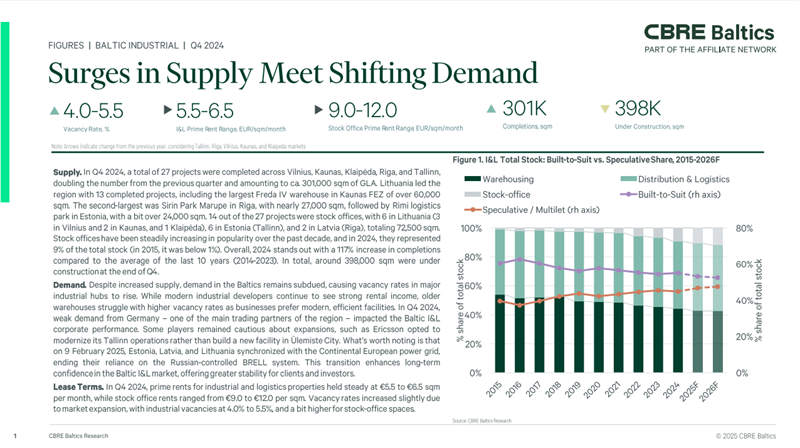

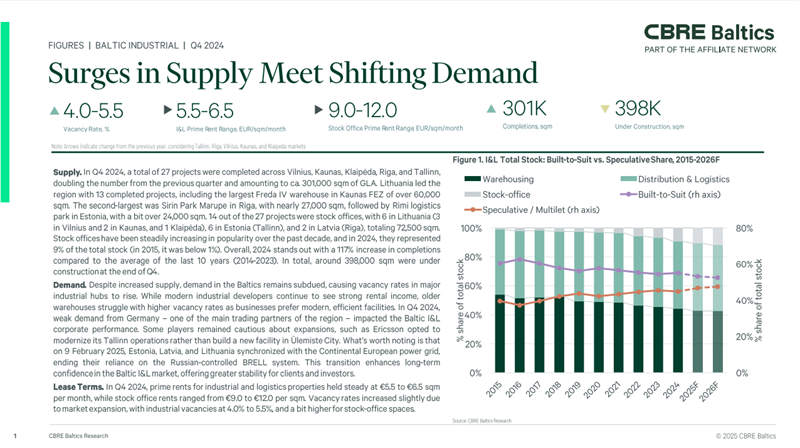

|  | | Industrial & Logistics KPIs | Overall, 2024 stands out with a 117% increase in completions compared to the average of the last 10 years (2014-2023). In total, around 398,000 sqm were under construction at the end of Q4. | |

|

|---|

|

| Regional Perspective: Central-Eastern European Market Q4 2024 |  |

|

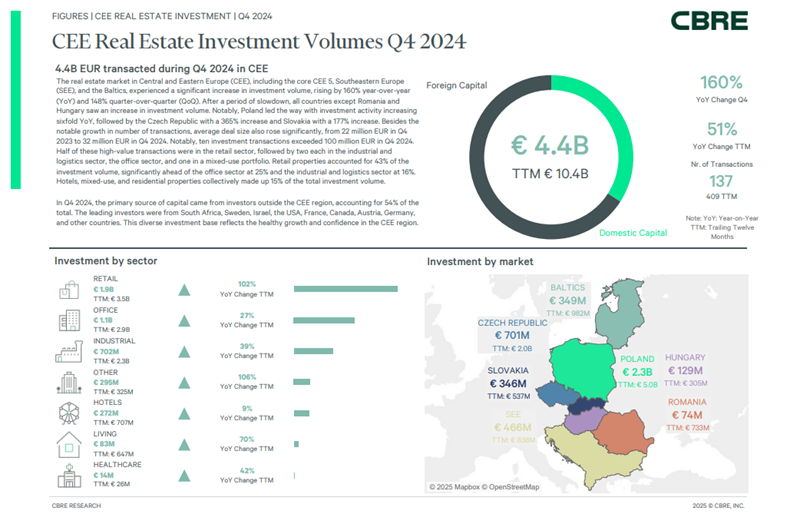

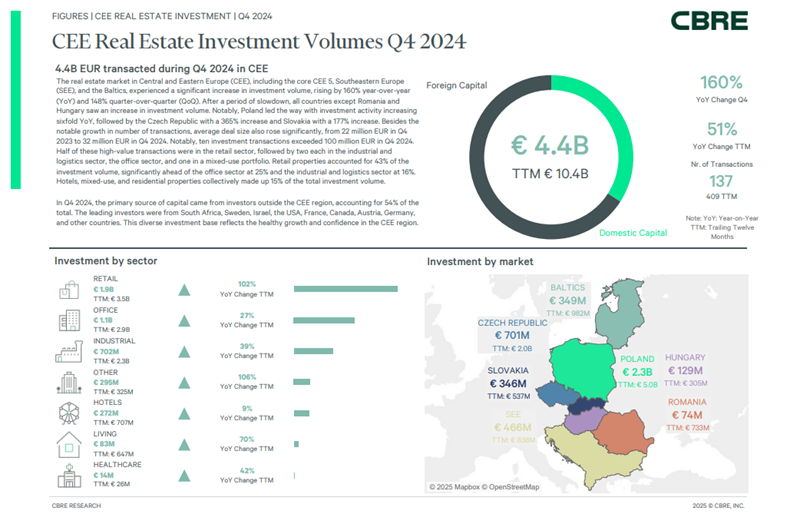

|  | | Investment KPIs | | After a period of slowdown, all countries except Romania and Hungary saw an increase in investment volume. Notably, Poland led the way with investment activity increasing sixfold YoY, followed by the Czech Republic with a 365% increase and Slovakia with a 177% increase. | |

|

|---|

|

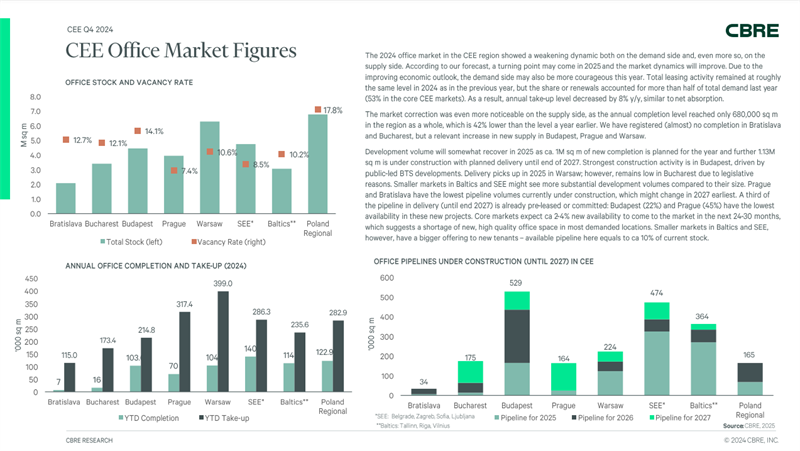

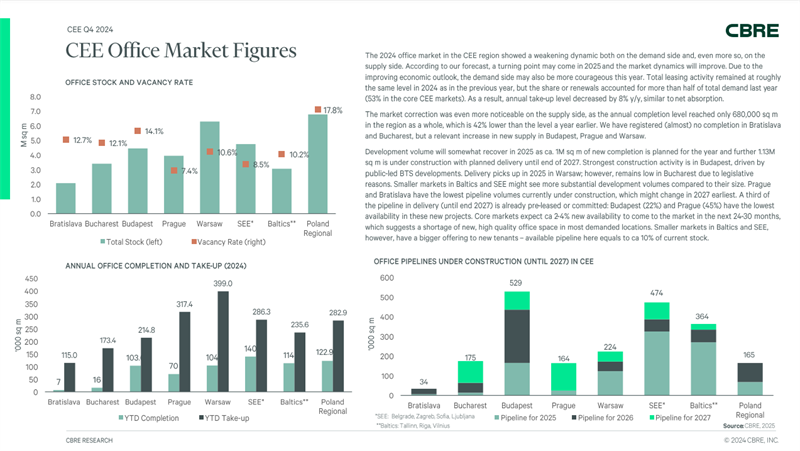

|  | | Office KPIs | | The 2024 office market in the CEE region showed a weakening dynamic both on the demand side and, even more so, on the supply side. According to our forecast, a turning point may come in 2025 and the market dynamics will improve. Due to the improving economic outlook, the demand side may also be more courageous this year. Total leasing activity remained at roughly the same level in 2024 as in the previous year, but the share or renewals accounted for more than half of total demand last year (53% in the core CEE markets). As a result, annual take-up level decreased by 8% y/y, similar to net absorption. | |

|

|---|

|

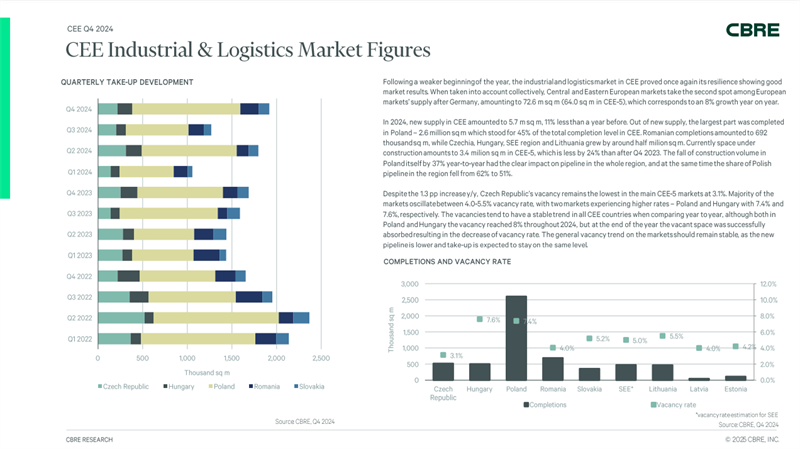

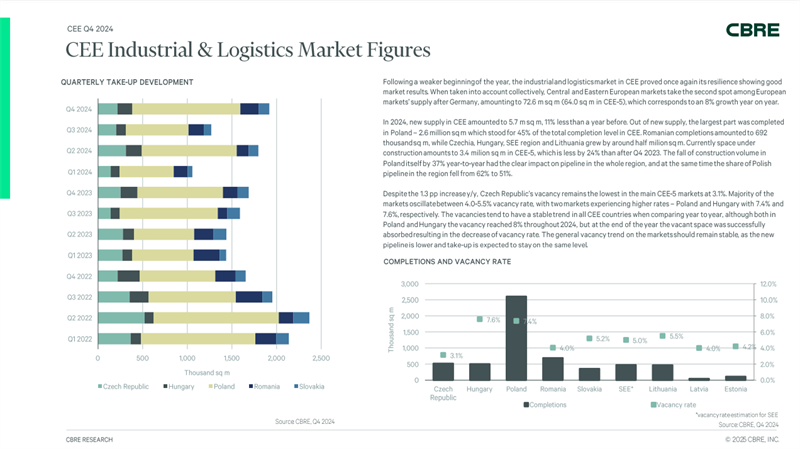

|  | | Industrial & Logistics KPIs | | Following a weaker beginning of the year, the industrial and logistics market in CEE proved once again its resilience showing good market results. When taken into account collectively, Central and Eastern European markets take the second spot among European markets’ supply after Germany, amounting to 72.6 m sq m (64.0 sq m in CEE-5), which corresponds to an 8% growth year on year. | |

|

|---|

|

| Baltic Research Team |  |

|

| |

|

|

Unsubscribe

CBRE Baltics Offices: - Z1, Zaļā Street 1, Riga, LV-1010, Latvia

- Saltoniškių Street 2-1, Vilnius, LT-08126, Lithuania

- Porto Franco, Laeva Street 1, Tallinn, EE-10111, Estonia

THIS IS A MARKETING COMMUNICATION© 2025 CBRE Limited All rights reserved. This information has been obtained from sources believed reliable, but has not been verified for accuracy or completeness. You should conduct a careful, independent investigation of the property and verify all information. Any reliance on this information is solely at your own risk. CBRE and the CBRE logo are service marks of CBRE, Inc. All other marks displayed on this document are the property of their respective owners, and the use of such logos does not imply any affiliation with or endorsement of CBRE. Photos herein are the property of their respective owners. Use of these images without the express written consent of the owner is prohibited. For information about how CBRE uses and processes your personal data, please click here. |

|